Women-led producer enterprises in rural India, perhaps more than many other businesses, continue to struggle with access to capital. Their needs are often not being acknowledged or understood by financial institutions from the very beginning. Thus, traditional financial instruments and mainstream finance products are not easily accessible to them, particularly when it comes to growth capital. The current global health crisis further exacerbates this problem.

Industree’s POWER (Producer Owned Women Enterprises) Project seeks to support 6,800 women directly and a total of 54,500 persons in communities, across bamboo value chains over 3 years. It recently partnered with USAID under the Women’s Global Development and Prosperity initiative that seeks to reach 50 million women in the developing world by 2025. To achieve this, however, innovative financing will be required. In this regard, Industree and USAID partnered with KOIS in an event to define how to sustainably finance the project.

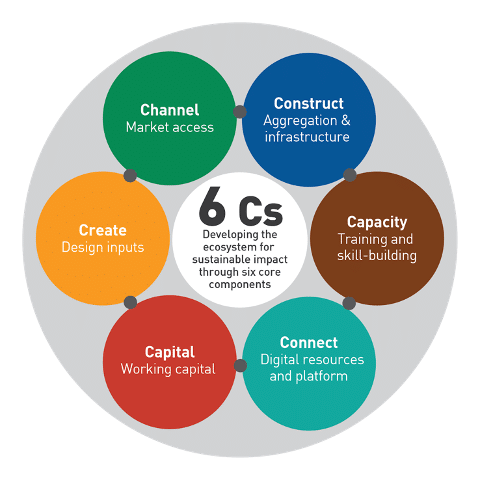

Collaboration was key in laying the groundwork for this project. The partners brought together the brightest minds from across the board: from impact investors, to donors, to corporations. They collectively shared ideas and actionable plans to solve for the lack of access to finance for rural women entrepreneurs.

One of the key highlights of the discussion was exploring the use-case of a result-based financial instrument, such as development impact bonds (DIBs). Such a mechanism offers outcome transparency, but must give special attention to pricing the risk profile correctly and ensuring long term sustainability of the enterprises, even after the project is over.

The collaboration: A USD10 development impact bond for the bamboo value chain

While exploring the potential of results-based instruments, the partners saw great value. The program will have an impact across the areas of livelihood, women empowerment, and environment in the bamboo value chain. Farmers would receive sustainable income from the third year onwards (i.e. the time between planting and harvesting bamboo), and for up to 30 years. Bamboo planting would also help to reduce atmospheric CO2 levels as well as carbon sequestration. Furthermore, bamboo does not need high quality or productive lands. Farmers can grow it on underutilized land as well, thus having no impact on food security.

As such, a USD10 million DIB, with potential to scale to USD25 million, was formed. This DIB (10M USD) would unlock the opportunity for incubating additional producer enterprises to access global markets and capital. Thereby reaching an additional 10,000 women directly and another 80,000 women indirectly. Essentially, The DIB at 10M USD would impact 10,000 women and at 25M USD would impact 25,000 women and so on.

In this result-based financing mechanism, social investors would provide the upfront capital and receive an outcome-based return. Industree, with over two decades of operational expertise, would manage the end-to-end setup and launch of the bamboo vertical; a third-party evaluator would collect, report, and assess the predefined outcome metrics. If the project realises the planned outcomes, the donors would reimburse the social investors the capital and interest.

The way forward

Industree & KOIS are currently structuring a financing mechanism. It will cover the implementation roadmap, measures & evaluation framework, financial and governance model for a financial instrument. Donors who are interested in results-based financing and the social goals are welcome to help co-create grassroot impact by reaching out to Industree or KOIS, or staying informed on their social media channels.

About the authors

Neelam Chhiber is Co-founder and Managing Trustee at Industree. For the past three decades, Neelam has been working on regenerative economies, with parts of India’s 200 million strong artisanal work force, by providing design, technical, marketing and management solutions to bridge the urban-rural divide.

Prabu Thiruppathy is a principal at KOIS.