Mental health in India

India’s mental health crisis afflicts ~15% of its population1. In fact, the prevalence of mental health disorders is increasing steadily from 125 mn population in 1990 to 197 mn in 20171. As per the global burden of disease study, suicide ranks as the third largest killer among adults in the working age group (15-49) in India. However, despite being a huge burden, and having recent policy and legislative attention, India’s expenditure on mental health was just 1.3% of government health expenditure in 20172.

This low proportionate spending on mental health is further exacerbated by underutilization of funds, low prioritization of mental health in States, and low coverage of health insurance for mental, neurological and substance use (MNS) disorders. The current COVID 19 pandemic, have only underscored the need for additional financing of mental health services, with a focus on increased mobilization of finances as well as effective allocation to address priority needs.

Multiple issues along the patient journey in mental health

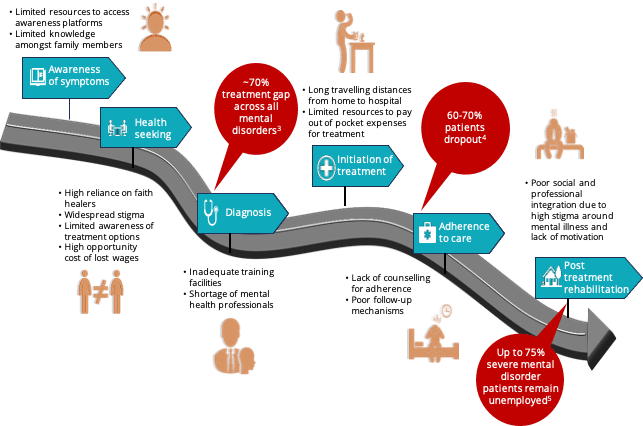

There are several challenges across the patient care journey of mental health in India, the same is illustrated below:

Innovative mental healthcare models

Effective and innovative mental health interventions can be scaled up quickly for improving mental health care delivery in the country. Some elements of the innovative mental healthcare delivery models can include the following:

- Embedding the awareness and detection, counselling, and referral into well-defined care pathways through front-line workers at the community level.

- Conducting behavioural change communication campaigns to destigmatize mental health issues and present the options for care for both patients and caregivers.

- Enabling anonymous modes to seek help, such as mental health helplines or apps.

- Improving accessibility by leveraging digital tools and technologies and strengthening mental health service delivery at primary and secondary care level.

- Using digital tools for the training of frontline workers to screen, diagnose, manage at-risk individuals, and of primary care doctors to treat mental health patients.

- Using mobile based (digital) decision support system to improve patient management wherein patient information can be accessed by frontline workers for effective delivery of mental health services.

- Improving adherence to care through psycho-social education, setting up follow-up mechanisms or change of treatment regimen with increased adherence.

Role of impact finance in scaling up mental healthcare models

Impact financing has emerged as a significant opportunity in the last few years, to mobilize capital into investments that target measurable socio-economic/health impact along with financial returns. In order to address two inherent issues with mental health financing, such as low-spending and underutilization of available expenditure, there is a need for bringing in impact financing to increase access as well improve efficiency of funding of mental health care in the Country.

Increase access to funding:

Innovative/impact finance instruments can attract private/risk capital, by reducing or externalising the risks during the early stages, into areas not traditionally funded such as mental health. Philanthropic actors can provide seed capital in the form of convertibles or competitive awards to fund innovative models across the mental healthcare spectrum. This can help develop proof of concepts that could be scaled by traditional venture capital or private sector players. Grand Challenges Canada’s Global Mental Health program6, for instance, focuses on funding high impact innovations that improve treatments and/or expand access to care for people, especially youth, living with or at risk of mental disorder.

Improve efficiency of funding:

Innovative finance can also be an effective mechanism in improving outcomes-per-dollar spent by ensuring incentives are aligned towards maximising outcomes. Service providers often face challenges in securing funding for large scale multi-year programs. Pay-for-success mechanisms (including impact bonds) and conditional financing instruments (such as milestone-based payments) help secure long- term commitments by allowing for donors to only pay for successful outcomes. These models can be particularly advantageous as donors only pay for measurable results, while the program implementor is made accountable to ensure the best program delivery. The Resolve Social Benefit Bond in Australia7, for example, has funded a recovery-orientated community support program that aims to support people who spend long periods admitted to mental health inpatient facilities or require frequent repeat care. This has generated savings for the New south wales Government through a reduction in participants’ utilisation of health and other services.

Thus, India needs impact financing for mental health care to complement public funding and for mobilizing resources from private sector and philanthropy, to bring innovative mental healthcare delivery models to scale.

Disclaimer: The views, thoughts, and opinions expressed in the article belong solely to the authors, and not necessarily to the author’s employer, organisation, committee, or other group or individual

[1] IHME, Global Burden of Disease

[2] Mental health financing challenges, opportunities, and strategies in low- and middle-income countries: findings from the Emerald project

[3] National Mental Health Survey 2015 16

[4] Evaluation of treatment adherence in outpatients with schizophrenia; Factors Affecting Non-Adherence among Patients Diagnosed with Unipolar Depression in a Psychiatric Department of a Tertiary Hospital in Kolkata, India

[5] A cross sectional study of employment pattern in patients with severe mental illness

[6] https://www.grandchallenges.ca/programs/global-mental-health/

[7] https://www.socialventures.com.au/work/resolve-sbb

About the authors

Shweta Bhardwaj is Associate Director of Global Policy at Johnson and Johnson

Aadit Devanand is Engagement Manager at KOIS India